Перевод и анализ слов искусственным интеллектом ChatGPT

На этой странице Вы можете получить подробный анализ слова или словосочетания, произведенный с помощью лучшей на сегодняшний день технологии искусственного интеллекта:

- как употребляется слово

- частота употребления

- используется оно чаще в устной или письменной речи

- варианты перевода слова

- примеры употребления (несколько фраз с переводом)

- этимология

accountants - перевод на Английский

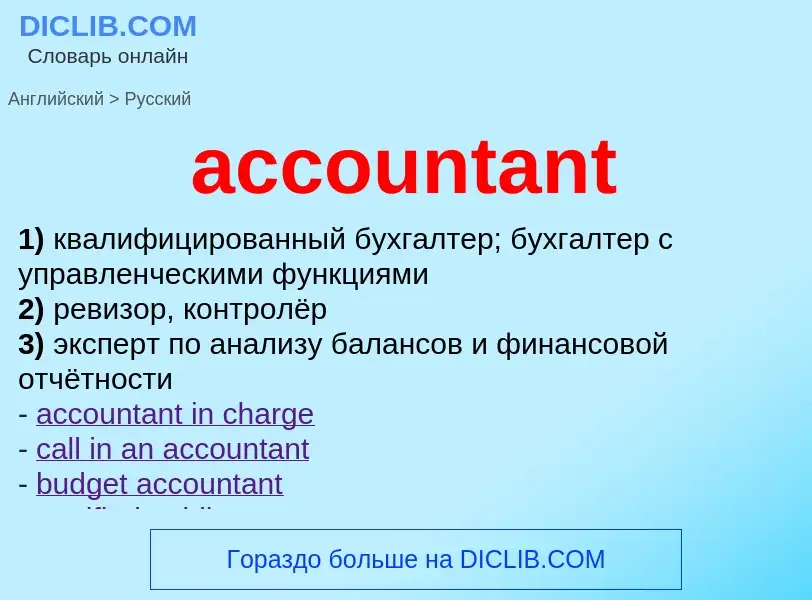

2) ревизор, контролёр

3) эксперт по анализу балансов и финансовой отчётности

- accountant in charge

- call in an accountant

- budget accountant

- certified public accountant

- chartered accountant

- chief accountant

- chief managerial accountant

- cost accountant

- factory accountant

- general accountant

- independent accountant

- industrial accountant

- management accountant

- managerial accountant

- office accountant

- private accountant

- professional accountant

- public accountant

- tax accountant

- works accountant

Смотрите также

[ə'kauntənt]

экономика

учетчик

бухгалтер

существительное

общая лексика

счетовод

ревизор

контролёр

фининспектор

бухгалтерский учет

бухгалтер

американизм

(по DOT: специалист, который на основании принципов бухгалтерского учета анализирует финансовую информацию и составляет финансовые отчеты; относится к группе "бухгалтеры, аудиторы и родственные специальности")

аудит

специалист по учету (лицо, оказывающее бухгалтерские услуги (напр., составление финансовых отчетов и налоговых деклараций, аудиторскую проверку финансовых документов и т. п.); часто специализируется на учете в определенных сферах (напр., налогообложении, производственном учете и т. п.))

финансы

эксперт по анализу финансовой отчетности

юриспруденция

ответчик

Определение

Википедия

An accountant is a practitioner of accounting or accountancy. Accountants who have demonstrated competency through their professional associations' certification exams are certified to use titles such as Chartered Accountant, Chartered Certified Accountant or Certified Public Accountant, or Registered Public Accountant. Such professionals are granted certain responsibilities by statute, such as the ability to certify an organization's financial statements, and may be held liable for professional misconduct. Non-qualified accountants may be employed by a qualified accountant, or may work independently without statutory privileges and obligations.

Cahan & Sun (2015) used archival study to find out that accountants’ personal characteristics may exert a very significant impact during the audit process and further influence audit fees and audit quality. Practitioners have been portrayed in popular culture by the stereotype of the humorless, introspective bean-counter. It has been suggested that the stereotype has an influence on those attracted to the profession with many new entrants underestimating the importance of communication skills and overestimating the importance of numeracy in the role.

An accountant may either be hired for a firm that requires accounting services on a continuous basis, or may belong to an accounting firm that provides accounting consulting services to other firms. The Big Four auditors are the largest employers of accountants worldwide. However, most accountants are employed in commerce, industry, and the public sector.